Promsvyazbank deposits for individuals and pensioners. Promsvyazbank: deposits for pensioners Promsvyazbank deposits for pensioners

Many elderly people think about where they can profitably invest their savings. Promsvyazbank pensioner deposit is ideal for such clients, because being on a well-deserved rest, you can receive a stable additional income in the form of interest on the deposit.

What pension deposits can be issued at Promsvyazbank

Promsvyazbank offers to open a My Pension deposit for clients who have already reached retirement age and want to place their savings on the most favorable terms. Here are the key features of this contribution.

Benefits of the My Pension deposit:

- high annual interest rate.

- replenishment of the deposit for any amount and during the entire period (except 30 days before the closing of the deposit).

- capitalization of interest on a monthly basis (at the choice of the client) or payment of income to a separate account/card.

If we talk about the shortcomings of this contribution, then they include:

- a ban on debit transactions on a deposit account;

- restriction on opening a deposit in favor of third parties.

The effective rate on this deposit offer is valid in case of:

- if there are no incoming/outgoing operations on the deposit during the entire period;

- interest capitalization option is selected.

Also, for pensioners, deposits in Promsvyazbank will be of interest, which are characterized by optimal conditions and availability of registration:

- "My benefit";

- "My piggy bank."

The “My Benefit” deposit, unlike the previous one, is automatically prolonged, and it can be issued to third parties. Payment of income is carried out at the end of the term.

The offer "My piggy bank" is perfect for those customers who need the replenishment function without any restrictions. With the help of this deposit, pensioners can save for any purpose: whether it is the purchase of goods, a trip on vacation or financial assistance to their grandchildren. The contract may be opened in the name of a third party.

Interest rates on Promsvyazbank deposits are quite low, if you look at the market average. What is the reason for this fact? According to experts, a reliable bank will not set maximum rates in order to attract gullible depositors. Average market rates are what characterizes the work of a stable financial institution. In addition, according to international rating agencies, Promsvyazbank has an impressive equity capital, which also testifies to its exceptional reliability.

It is worth noting such an important nuance as the fact that in Promsvyazbank deposit insurance is a prerequisite and is carried out automatically.

How to make a pension deposit of Promsvyazbank

In order to place the accumulated savings on a deposit account for pensioners, you must:

- provision of a pension certificate.

For other deposits of Promsvyazbank, the original passport or other identification document is sufficient.

Options for placing the deposit amount:

- by depositing cash through the bank's cash desk;

- transfer from any current / savings account previously opened with this bank;

- transfer from an account opened with another bank, if the terms of the deposit provide for replenishment.

Deposit methods:

- operator in the department;

- submitting an online application on the bank's portal;

- in the personal account of the Internet bank PSB-Retail.

The algorithm for opening a deposit in the office of a financial institution:

- Familiarize yourself with the conditions for attracting a deposit, then choose: currency, period of placement of funds, method of receiving income (on a card / account) or capitalization of interest.

- If any questions arise, they should be asked to the teller before signing the deposit agreement. It is important to study all the nuances so that the conditions of the deposit fully meet your expectations and needs. In Promsvyazbank, interest on deposits may differ depending on the amount and period of placement of funds.

- Provide a bank employee with a passport (pension certificate - for opening a pension deposit).

- Sign an application for placing a deposit, as well as other necessary documents.

- Make a deposit through the cash desk, after which the operator will give you a receipt stating that your money has been credited to the account.

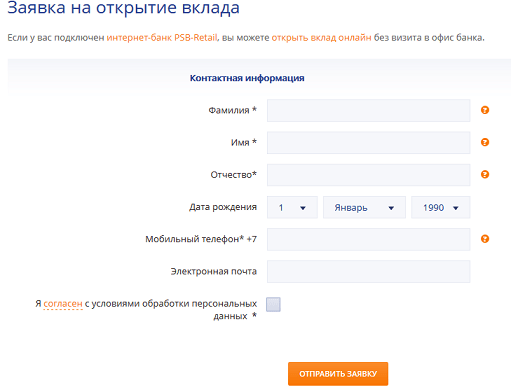

The procedure for filling out an application for a deposit on the bank portal:

- Open the deposit selection assistant for individuals.

- Choose the optimal deposit program.

- Click the "online application for a deposit" button and fill in the following fields in the questionnaire that opens: personal data, mobile phone, e-mail, date of birth.

- Then select the deposit and check the box confirming your consent to the terms of personal data processing.

- Send an application and wait for a call for an invitation to the bank's office to complete the deposit procedure.

To open a deposit in your personal Internet banking account, you need to be a registered user of PSB-Retail and have the required amount of the down payment on any of the open accounts.

- If you decide to open a deposit, for example, in rubles, then additional contributions that are possible under the terms of the agreement must also be in rubles. That is, the replenishment currency corresponds to the deposit placement currency.

- You don't have to visit the bank to get a statement of your deposit account. You can find out all the relevant information without leaving your home - through the Internet bank.

- Additional contributions can be made both in cash and non-cash form. It is very convenient for pensioners to transfer a certain amount of funds from their pension card every month to a deposit account in this way.

- Interest accrued by a credit institution on one deposit may be a source of replenishment of another deposit, if this is provided for by the terms of the agreement.

- In Promsvyazbank, deposits can be issued as part of remote service if you are a user of the PSB-Retail Internet bank. There you can also change the method of calculating interest on the deposit.

One of the largest financial institutions in the Russian Federation, Promsvyazbank, a joint-stock commercial bank, appeared in 1995 as an institution serving the largest communications enterprises, that is, as an ordinary and, in general, unremarkable narrow-industry bank. However, soon the institution began to actively develop. The bank took up lending to the population, opened deposits in rubles and foreign currency, launched leasing programs, began financing private business projects, entered the service of all subjects of the federation, and eventually became a large financial institution with a wide range of profiles.

Why deposits in Promsvyazbank are a reliable and profitable solution?

Currently, Promsvyazbank firmly occupies a leading position among all banks in Russia, year by year gaining the respect of an increasing part of the population. Some statistics:

- Promsvyazbank ranks 12th in terms of capital, as well as the volume of assets (as of 2013);

- this bank occupies the 10th place in the rating of volumes of attracted deposits over the past year;

- Currently, Promsvyazbank is one of the 500 most stable and prosperous banks in the world.

The Bank, as a financial institution with a long positive history, adheres to an adequate and traditional conservative policy, long-term planning, accurate forecasts regarding financial market fluctuations and a balanced assessment of possible risks.

Promsvyazbank, assessing the financial situation and the standard of living in the country, in 2019 proposed a number of programs for individuals on optimal conditions for various segments of society. The bank has provided several options for depositors:

- the ability to accumulate funds and withdraw them before the expiration of the agreement with the bank without loss;

- the ability to store savings in different currencies at the same time;

- the ability to open a deposit without visiting bank branches, through an ATM or an Internet representation (it is worth noting that in this case, the interest rates on the deposit will be higher than when visiting a bank - the electronicization of document flow is becoming an increasingly common phenomenon in the banking environment);

- the possibility of using other material instruments - precious metals and stones, even in an impersonal form.

Deposits in Promsvyazbank in 2019 of your choice

In 2019, Promsvyazbank offers its customers three deposit options to choose from. It is assumed that each of the depositors will be able to find the best option for themselves - from a term (“instant”) deposit to a replenishable one that allows partial withdrawal of funds.

- deposit "My benefit" today is perhaps the most popular among the three possible tariff plans. This is due to the fact that it is “My benefit” that provides the highest possible interest on the deposit - from 7.0 to 9.0 with a minimum investment of ten thousand rubles or three hundred US dollars or euros to a million rubles or 30 thousand dollars or euros (so the name of the deposit is fully justified). The benefit also lies in the fact that the term of the agreement with the bank is chosen by the client himself, and this period can vary from six months (which is very convenient) to three years (quite a standard term). During the term of the agreement, capitalization of interest is carried out every month, however, the possibility of early withdrawal of funds and additional deposits is completely excluded. The “My Benefit” offer will be useful even for pensioners: with an adequate amount of the entry fee, you can open a good deposit in favor of grandchildren and children;

- rates for deposit "My Opportunities" slightly lower than in the previous described case, and vary from 6.0 to 7.4 percent, and the interest rate depends entirely on the exchange rate at the time of the conclusion of the contract. It is this deposit that is characterized by the ability to store funds simultaneously in different currencies: you can put on a deposit account from fifty thousand rubles, 30 - for the regions (or one thousand dollars or euros, 500 - for the regions), and both national and foreign currencies can be put in parallel. Funds can be cashed out, moved between different accounts and make additional contributions. The agreement with Promsvyazbank may be valid from six months to a year or two years;

- finally, deposit "My pension" is one of the key areas of the Bank's social policy in 2019. The conditions of this tariff plan are quite simple, but, nevertheless, quite attractive not only for people of retirement age, but also for other people who care about their future. The lower limit of the deposit is at the level of three thousand rubles or five hundred US dollars (or euros), while the interest rate is even higher than under the My Opportunities tariff - from 8.5 to 9.0 percent per annum, interest is capitalized monthly. The term of the agreement with the bank is not limited, since it is automatically extended.

In 2019, the most profitable deposits were added to the standard offers, such as “Generous interest” (up to 14% in rubles and 5.15% in dollars, 5% in euros and a placement period from 1 month to a year), “Multi-currency basket” (up to 10% in rubles and up to 3.5% in dollars or euros), “My piggy bank” (replenished deposit with a rate of up to 9.5% in rubles and 3% in US dollars).

If you visualize how the deposit works in the form of a simple table, then your savings will look something like this (it’s worth mentioning right away that this is just an example that shows the accrual scheme, it can still change depending on the conditions of the bank):

Of course, a tangible income from deposits can only be obtained with long-term deposits or by putting a large amount of money on a deposit. Otherwise, it is worth considering the deposit as a legal and reliable preservation of the integrity of funds without reducing their cost.

There is a special offer for visitors to our site - you can get a free consultation from a professional lawyer by simply leaving your question in the form below.

The line of offers for deposits varies in Promsvyazbank from year to year. Bank customers can easily move funds through their accounts, track transactions using Internet banking, manage deposits, replenish them, or use accumulated funds. It is possible that next year the bank will please its customers with new attractive offers.

Today, many pensioners seek to profitably make a deposit in rubles or foreign currency in order to secure a decent old age and a small but stable increase in their pension. A good option would be to contact Promsvyazbank, where really profitable options with high interest rates are offered for people of retirement age.

Are there any special offers for pensioners?

Back in 2018, the bank offers a specialized program for people who have retired on a well-deserved vacation - "My Pension". The deposit is replenishable without restrictions on the amount of additional contributions.

Interest is paid monthly, with automatic renewal. The minimum amount is 3000 rubles, the placement period is 181, 367 or 731 days.

Depending on the term of the deposit, the interest rate will be up to 7.23% in rubles. To apply, you will need a pension certificate.

Unfortunately, this offer no longer exists in 2019, this contribution has been classified as archival. Those contracts that were drawn up earlier continue to be valid until their date, but new ones can no longer be concluded.

What other suggestions should you pay attention to?

In addition to the program proposed above, we have compiled a list of other profitable products that anyone can use. Of the advantages here, one can note a small amount of the first installment, as well as a flexible choice in terms of the duration of the contract.

- “My income” is the offer with the highest yield up to 7.5% per year. You will need to invest at least 100 thousand for 3 months; when placing via the Internet, there is an increased percentage (+0.25 p.p.). Preferential conditions for early termination apply. Payment at the end of the term can be opened in favor of a third party.

- "My benefit" is issued for a period of 32 to 1095 days. The interest rate will depend on the amount and term of the deposit, the maximum value of income is up to 7.1% in rubles. The minimum amount is 10,000 rubles, replenishment is not provided. Accrued interest is paid at the end of the period. The deposit can be issued to a third party, it is possible no more than 3 times.

- "My piggy bank" - under this offer, a yield of up to 6.87% per annum is available. The required amount to open an account is from 10,000 rubles in the regions and from 50,000 rubles in Moscow. The term is 181 or 367 days, you can independently choose the procedure for paying interest, there is the possibility of replenishing the account. There are allowances for pensioners;

- “My Opportunities” is a replenishable deposit, where part of the accumulated funds can be withdrawn (up to a minimum balance). To open, you will need an amount of 30 thousand rubles for the regions and 50 thousand rubles for residents of Moscow. The term is 181, 367 or 731 days, the maximum rate is 6.19% per annum.

- “Profitable” is a current account that is replenished with the possibility of making debit transactions and opening it to another person. The investment period can be any. The maximum yield is up to 6% with an account balance of 5000 rubles. Interest payments are made monthly, capitalization occurs.

- You can also choose the “Accent on interest” account, where, when using a BSP card with the investment option connected, you can count on an increased income of up to 8% per annum.

To calculate the profitability of opening a deposit, you can use the online calculator:

How to open a deposit in Promsvyazbank?

If you or your relative is dealing with the registration of a deposit banking product for the first time, then you may have questions related to opening an account. In fact, there is nothing complicated here - the bank has provided various opportunities for its customers that you can use:

- personal appeal of the pensioner to the bank. In this case, you will need to take your passport, pension certificate and the amount that you plan to deposit with you. You can also pay this fee using an account or card if they are opened in the same company. At the branch, you turn to the teller for help, he will calculate all the conditions for you and draw up an agreement. You sign it, deposit money through the cashier and that's it, the deposit is open,

- referral of a trusted person. If your relative is already elderly and has health problems that make it difficult for him to travel long distances, you can make a deposit on his behalf at any of the bank branches. To do this, your grandfather or grandmother must draw up a power of attorney and certify it with a notary. After that, you need to perform the same algorithm of actions as in the paragraph above,

- through the Internet. If a pensioner is an active client of Promsvyazbank, he can connect using his card or account to the Internet banking system and open a deposit account online.

In the latter case, the sequence of actions will be as follows:

- Log in to the system at ib.psbank.ru

- Open the deposit selection assistant.

- Choose the best deposit program for you.

- Click on the "Online Application for Deposit" button,

- On the new page, fill in the following fields: personal data, mobile phone, email, date of birth.

- Check the box confirming your consent to the terms of personal data processing.

- Submit an application.

Promsvyazbank in 2019 offers to open profitable deposits for individuals at high interest rates. Consider what rates today can be claimed by ordinary depositors, pensioners and premium clients.

Promsvyazbank is one of the top 10 largest banks in Russia and is a universal commercial bank with a history of 20 years. It was recognized by the Central Bank of the Russian Federation as one of the financial institutions.

Branches of Promsvyazbank operate in Moscow, St. Petersburg, Krasnodar, Nizhny Novgorod and many other Russian cities. The regional network of Promsvyazbank includes more than 300 offices, more than 10,000 ATMs (including ATMs of partner banks) and more than 200 self-service terminals throughout the country.

Promsvyazbank has been selected as a reference bank for the implementation of the state defense order and support of major government contracts, it provides a full range of services to retail and corporate clients, small and medium-sized businesses, the website reports.

Promsvyazbank deposits for individuals are insured by the state, which means that the depositor can always count on compensation in the amount of up to 1.4 million rubles.

Promsvyazbank deposits for pensioners: increased rates

Pensioners can draw up any of the deposits offered by Promsvyazbank on general terms. But in the line of bank deposits today there are also special offers for women over 54 and men over 59 years old. They can get interest rate surcharge of + 0.1% when opening or prolonging deposits: "My income", "My piggy bank" and "My opportunities".

Promsvyazbank 2019: interest on deposits of individuals

In 2019, Promsvyazbank deposits for individuals can be opened in rubles, dollars and euros, depending on the strategies for accumulating funds. For pensioners today, higher rates are provided for the My Piggy Bank deposit, there are special deposits for premium clients. The site site has compiled an up-to-date overview of Promsvyazbank's current deposits.

Deposit of Promsvyazbank "My income"

This is a classic deposit of individuals with the possibility of obtaining maximum income and early termination on favorable terms, the site reports. You can apply for it at the branch or online. The deposit can be opened in favor of third parties.

Conditions

- Currency: Russian rubles / US dollars;

- Deposit term: 122, 181, 367, 547, 731 days;

- Minimum amount: 10,000 rubles.

- Expenditure operations: not provided;

- Replenishment: provided within the first 30 days from the date of opening;

Interest rates

Allowances:

0.10% when placing or prolonging a deposit for pensioners (provided to women over 54, and men from 59 years old with a deposit amount of 100,000 rubles).

+ 0.10% when placing a deposit on the Internet and mobile banking, as well as at ATMs.

Calculation. The maximum yield on the “My income” deposit in the amount of 7.5% per annum in rubles is achieved when opening an online deposit in the amount of at least 1 million rubles for a period of 547 days. In this case, the income for 1.5 years will be 112,397 rubles. You will receive 1,112,397 rubles in your hands.

Calculate the possible income on the deposit

Few? See what interest on deposits it offers today

Deposit of Promsvyazbank "My Benefit"

This is a replenishable deposit of individuals with the possibility of obtaining a decent income and early termination on preferential terms. It can be opened at the bank office and in the PSB-Retail Internet Bank.

This is a replenishable deposit of individuals with the possibility of obtaining a decent income and early termination on preferential terms. It can be opened at the bank office and in the PSB-Retail Internet Bank.

Conditions

- Currency: Russian rubles, US dollars, euros.

- Term: 32-731 days. in Russian rubles / 91-1095 days. in US dollars and euros;

- Minimum amount: from 10,000 rubles / 300 US dollars / 300 euros;

- Replenishment: provided;

- Expenditure operations: not provided.

- Interest payment: at the end of the deposit term.

- Conditions for early termination: preferential. When closing the deposit after the 90th day, interest is paid at the rate of 1/2 of the interest rate.

Interest rates

Allowances:

0.10% when placing a deposit on the Internet and mobile banking.

Doesn't fit? See what interest on deposits it offers today

Deposit of Promsvyazbank "My piggy bank"

This is a replenishable deposit with monthly interest. They can be received on hand, or they can be capitalized by increasing the amount of the deposit. For premium clients, there is a surcharge to the interest rate.

This is a replenishable deposit with monthly interest. They can be received on hand, or they can be capitalized by increasing the amount of the deposit. For premium clients, there is a surcharge to the interest rate.

Conditions

- Currency: Russian rubles, US dollars.

- Term: from 181 to 731 days;

- Minimum amount: 10,000 rubles / 300 US dollars;

- Replenishment: provided;

- Expenditure operations: not provided;

- Interest payment: monthly capitalization or payment to the account;

Interest rates

Allowances:

Deposits of Promsvyazbank "My Opportunities"

This is the so-called "spending" deposit for individuals with the possibility of replenishment and withdrawal of funds without loss of interest. There is a surcharge for premium clients. You can open a deposit at the bank office or in the PSB-Retail Internet bank.

This is the so-called "spending" deposit for individuals with the possibility of replenishment and withdrawal of funds without loss of interest. There is a surcharge for premium clients. You can open a deposit at the bank office or in the PSB-Retail Internet bank.

Conditions

- Deposit term: from 181 to 731 days;

- Minimum amount: 50,000 rubles. / $300;

- Maximum amount: 20 million rubles / 500,000 US dollars;

- Replenishment: provided;

- Debit transactions: provided without loss of interest, provided that the minimum balance of the deposit is maintained.

- Interest payment: monthly capitalization or payment to the account of the client's choice.

- Terms of early termination: at the rate of the deposit "on demand".

Interest rates

Allowances:

0.15% for owners of banking service programs when opening a deposit for a period of 6 months or more in the amount of 500,000 rubles.

0.10% for pensioners when opening a deposit for a period of 6 months or more in the amount of 10,000 rubles.

0.10% when placing a deposit in the Internet bank.

Not satisfied? See what rates on deposits in

Deposit of Promsvyazbank "My Strategy"

This is a comprehensive solution for effective savings. Clients who have issued a policy under the investment life insurance program can open a deposit.

This is a comprehensive solution for effective savings. Clients who have issued a policy under the investment life insurance program can open a deposit.

Conditions

- Deposit term: 181, 367 days;

- Minimum amount: 50,000 rubles;

- Maximum amount: 3 million rubles;

- Replenishment: not provided;

- Expenditure operations: not provided.

- Interest payment: at the end of the term.

Interest rates

> 8.0% per annum with an amount of 50,000 rubles or more;

> 8.2% per annum with an amount of more than 1 million rubles.

In case of early termination of the investment life insurance contract, the interest rate of the deposit can be reduced by 1 percentage point!

See also what interest on deposits it offers today

Savings accounts of Promsvyazbank

To store savings, customers can open not only Promsvyazbank deposits, but also savings accounts. They combine flexible conditions for managing funds and high profitability.

"Profitable"

The account offers more flexible conditions and the opportunity not only to save money without much effort, but also to receive additional income both in rubles and in foreign currency. The account is available for opening at the bank office and on the Internet. Connection of accumulation rules: “Replenished-accumulated” and “Bought-accumulated”.

The account offers more flexible conditions and the opportunity not only to save money without much effort, but also to receive additional income both in rubles and in foreign currency. The account is available for opening at the bank office and on the Internet. Connection of accumulation rules: “Replenished-accumulated” and “Bought-accumulated”.

Conditions

- Currency: Russian rubles;

- Minimum account balance during a calendar month: from 5,000 rubles;

- Replenishment: without restrictions on the amount and term;

- Withdrawals: no loss of interest;

- Monthly interest payment;

- Interest paid is capitalised.

Interest rates

See what interest has the most profitable deposits for pensioners in

"Percentage Emphasis"

This offer can be especially beneficial for those who regularly pay for purchases using Promsvyazbank debit or credit cards, and for fairly large amounts. You can open a savings account "Accent on Interest" at the bank's office or in a mobile or Internet bank.

This offer can be especially beneficial for those who regularly pay for purchases using Promsvyazbank debit or credit cards, and for fairly large amounts. You can open a savings account "Accent on Interest" at the bank's office or in a mobile or Internet bank.

Conditions

- Minimum deposit: not set.

- Replenishment: no limits.

- Withdrawals: no limits.

- Interest payment: monthly with capitalization.

Base interest rates

If the minimum balance on the account is more than 700 thousand rubles, then for the amount up to 700 thousand rubles the client will receive income at a rate of 6.5% per annum, for amounts over 700 thousand rubles - at a rate of 5.5% per annum!

How to get a higher rate?

Pay for purchases with PSB cards in the amount of 10,000 rubles or more and receive a surcharge on the rate from 0.3% to 1.5%.

The maximum rate of 8% per annum on the Accent on Interest account can be obtained if you have up to 700,000 rubles in your account and spend from 85,000 rubles per month on the PSB card.

Promsvyazbank deposits for premium clients

1. Contribution "Orange Welfare"

This is a banking product for premium clients, which allows you to get a high rate on a bank deposit, as well as form endowment capital and provide financial support in an unforeseen situation.

One part of the client's funds is placed in a deposit with an increased interest rate, and the other part is placed in one of the accumulative life insurance programs (CLS) of IC Ingosstrakh-Life.

Conditions

| Contribution | NSJ | |

| Currency | Russian rubles | Russian rubles |

| Term | 181, 367 days | From 10 years old |

| Minimum amount | from 50 000 rubles | from 100,000 rubles (for contributions of the first year) or from 400,000 rubles (for one-time contributions) |

| Replenishment | Not provided | Through additional contributions to the program |

| Interest/income payment | At the end of the term | At the end of the term |

| Debit transactions | Not provided | Not provided |

| Yield/amount upon early termination | According to the rules for calculating redemption amounts | |

| Insurance at DIA | insured | Not insured |

Interest rate

> 8.0% per annum in rubles for a term of 181 days;

> 8.2% per annum in rubles for a period of 367 days.

2. Contribution "Investment income"

This is a complex deposit for premium clients, combining the reliability of a bank deposit and the investment opportunities of the stock market.

One part of the client's funds is placed on a term deposit with an increased interest rate, and the other part is invested in mutual funds (UIFs) managed by PROMSVYAZ.

Conditions

| Contribution | mutual fund | |

| Currency | Russian rubles, US dollars | Russian rubles |

| Term | 184 days | Is not limited |

| Minimum amount | 50 000 rubles | 50 000 rubles |

| Replenishment | Not provided | By purchasing shares |

| Interest/income payment | At the end of the term | When redeeming shares |

| Debit transactions | Not provided | By redeeming shares |

| Yield on early termination | At the rate of the deposit "On Demand" | Difference between unit purchase and redemption value |

| Insurance at DIA | insured | Not insured |

Interest rates

> 7.7% per annum in rubles.

How to make a deposit: instructions

There are two ways to open a deposit at Promsvyazbank: at a branch and online via the Internet.

How to make a deposit through Internet banking

- Issue a card or open an account and conclude a remote banking service agreement at any bank office.

- If you are already connected to the PSB-Retail system, then you automatically get the opportunity to open deposits through the Internet bank.

- Go to your personal account in the PSB-Retail Internet bank in the "Deposits" section.

- Press the "Open deposit" button on the screen and select the deposit that suits you.

- Funds in favor of an open deposit of your choice will be debited from your bank card account, current account or demand deposit opened with Promsvyazbank.

- Confirm the operation and the deposit is open.

- You can get a document confirming the opening of a deposit at any bank office.

How to make a deposit at the bank office

- Visit the bank office with a passport or other identification document.

- Sign the application for joining the rules for placing deposits and other necessary documents that the bank operator will print out for you.

- Make a cash deposit through the cash desk or make a transfer from any of your accounts opened with Promsvyazbank.

- After depositing funds (in cash or by transfer from an account), the operator will issue you a confirmation of the placement of a bank deposit.

List of documents for making a deposit

- Identification document (passport or other document);

- TIN (if any);

- SNILS (if available).

Conclusion

Popular

- How to register online in the Uralsib Internet Bank and log in to your personal account

- How to transfer money between your cards

- How to force the bank to return the interest on the loan

- How to play Forex from scratch, without own investments, and is it possible?

- Choosing a currency pair for a forex trader

- Best currency pairs for beginners in Forex trading - what to choose

- Additional debit card Tinkoff Black

- Loans for working capital financing

- Visa Electron card from Sberbank: debit or credit

- How to find out the owner by Sberbank card number 4890 4945 5302 0587 whose card